Cuban-American legislators have expressed strong opposition to the changes announced this Tuesday by the Biden Administration regarding U.S. policy towards Cuba, which includes granting the private sector access to the American banking system.

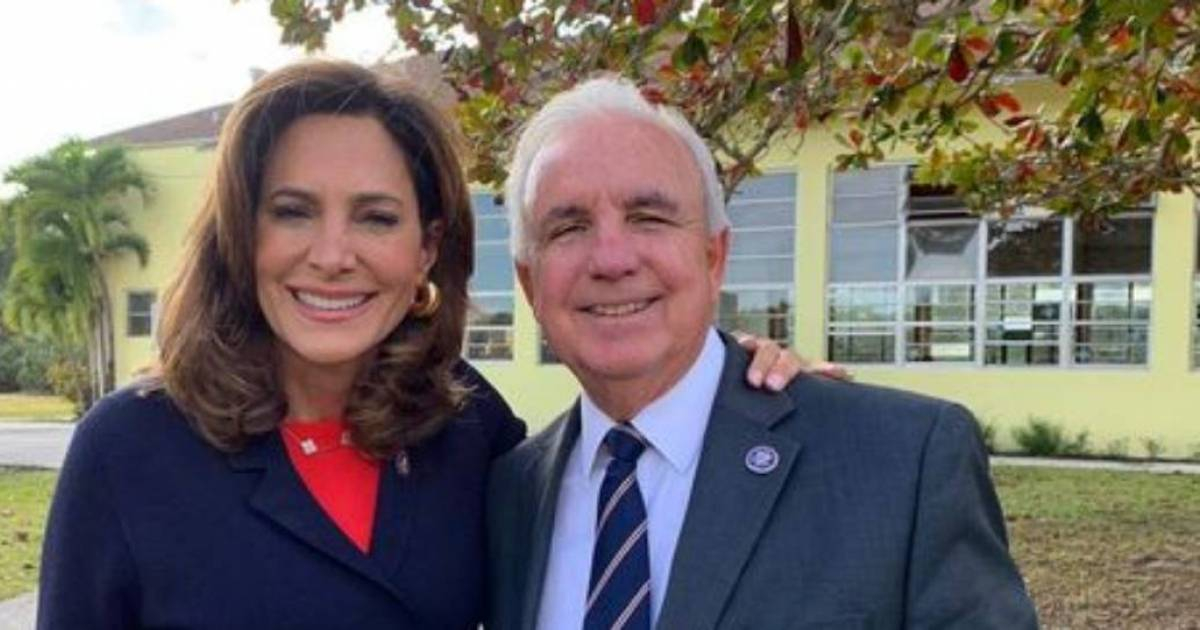

In his X account, Republican Congressman Carlos Giménez accused the Biden administration of perpetuating "the Castro dictatorship in power and abandoning the Cubans who fight for freedom," while calling it "an accomplice" of the communist regime. "President Biden has just granted more concessions to Cuba's murderous regime," he stated.

Meanwhile, legislator María Elvira Salazar argued that opening the U.S. banking system to the 'private sector,' which she considers "a front for the regime to obtain foreign currency," will give "more lifeline to the dictatorship."

Reactions to Treasury Department's Measures

The senators were responding to measures from the U.S. Department of the Treasury, which through the Office of Foreign Assets Control (OFAC) approved new amendments to the Cuban Assets Control Regulations on Tuesday. These changes are purportedly aimed at "increasing support for Cuban private sector entrepreneurs" and "promoting internet freedom on the island."

The amendments, which will take effect upon their publication in the Federal Register on May 29, 2024, include key measures such as authorizing cloud-based services to facilitate internet communication and expanding services for the installation and repair of telecommunications equipment.

Additionally, there will be permissions for the export and re-export of Cuban-origin software and mobile applications from the United States to third countries.

Another significant modification is the redefinition of the term "independent private sector entrepreneurs," now excluding prohibited government officials of Cuba and members of the Cuban Communist Party. This new definition encompasses not only self-employed workers but also cooperatives and other private enterprises with up to 100 employees.

However, evidence shows that several Cuban SMEs are composed of relatives of Castro regime leaders and officials, including even deputies of the regime.

Furthermore, the authorization for "U-turn" transactions has been reinstated, allowing banking institutions to process fund transfers involving Cuba, as long as these originate and terminate outside the U.S. and do not involve persons subject to U.S. jurisdiction. This means Cuban private sector entrepreneurs can access accounts in American banks and conduct financial transactions from third countries (U-Turn transactions) to send remittances and other payments to individuals on the island.

The reporting process for telecommunications-related transactions has also been updated, eliminating the need to send faxes and allowing reports to be sent via email.

Understanding the U.S. Policy Change Towards Cuba

In light of the recent policy changes by the Biden Administration towards Cuba, here are some frequently asked questions to better understand the implications and reactions.

What are the key changes in the U.S. policy towards Cuba?

The key changes include granting the Cuban private sector access to the American banking system, authorizing cloud-based services, expanding telecommunications services, and redefining "independent private sector entrepreneurs."

Why are Cuban-American lawmakers opposing these changes?

Cuban-American lawmakers argue that these changes will perpetuate the communist regime in Cuba and provide it with financial lifelines, rather than supporting genuine private sector growth.