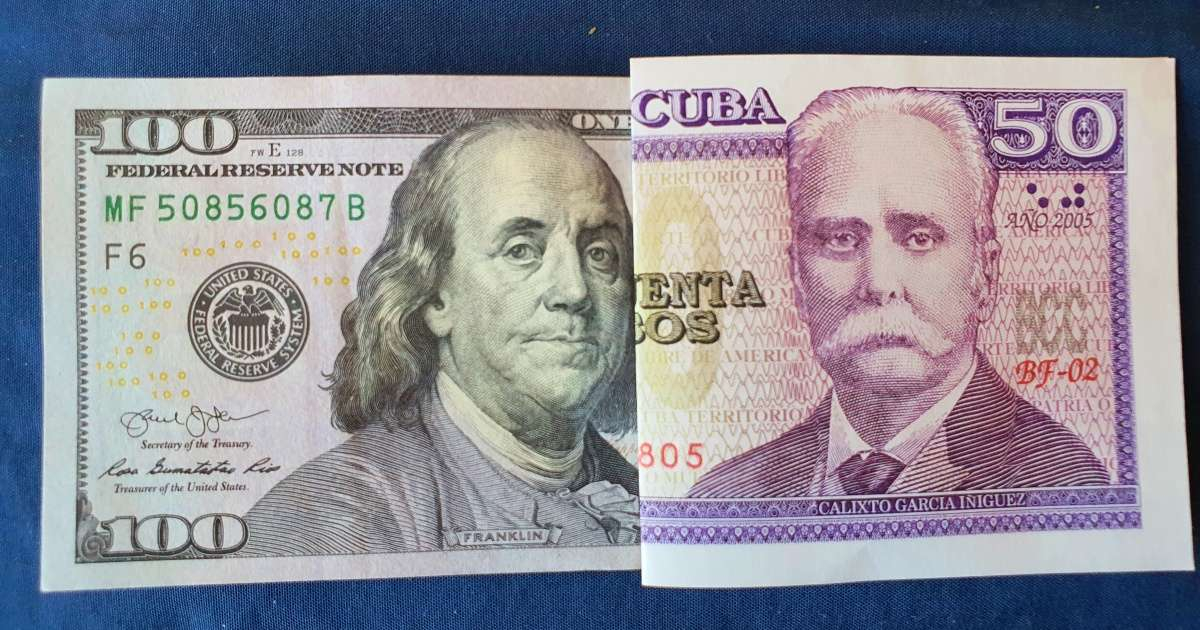

The US dollar and the Freely Convertible Currency (MLC) saw another drop in their average selling prices in Cuba's informal market this Monday. At 7:00 a.m. local time on July 8, the US dollar was being sold at 340 CUP, three pesos less than the previous day. According to the new average value, 5 USD would be equivalent to 1,700 CUP, and 10 USD would convert to 3,500 CUP.

The MLC also suffered a decrease, dropping by five units. It now stands below the 300 mark at 295 CUP. Meanwhile, the euro remains stable at 350 CUP, a value it reached over the weekend.

Current Exchange Rates in Cuba

As of 7:00 a.m. on July 8, 2024, the informal exchange rates in Cuba are as follows:

USD to CUP according to elTOQUE: 340 CUP.

EUR to CUP according to elTOQUE: 350 CUP.

MLC to CUP according to elTOQUE: 295 CUP.

It should be noted that these informal exchange rates are not officially recognized or backed by any financial or governmental entity.

Here are the equivalences for available US dollar and euro bills to Cuban pesos (CUP) as per Monday's rates:

US Dollar (USD) to Cuban Peso (CUP)

1 USD: 340 CUP

5 USD: 1,700 CUP

10 USD: 3,400 CUP

20 USD: 6,800 CUP

50 USD: 17,000 CUP

100 USD: 34,000 CUP

Euros (EUR)

1 EUR: 350 CUP

5 EUR: 1,750 CUP

10 EUR: 3,500 CUP

20 EUR: 7,000 CUP

50 EUR: 17,500 CUP

100 EUR: 35,000 CUP

200 EUR: 70,000 CUP

The recent decline in the value of the dollar and the MLC occurs amid ongoing conflicts between private businesses and the Cuban government. The government's decision to cap prices on essential goods sold in the retail network has sparked significant discontent in the private sector. According to the announcement, the centralized pricing system will initially target chicken, oil, powdered milk, pasta, sausages, and powdered detergent in an effort to curb rampant inflation affecting Cubans.

"If you want essential goods to keep coming in, this is not the way," warned an entrepreneur about the government's price cap decision on six basic products sold by the private sector. In March, Miguel Díaz-Canel promised a package of economic measures to "correct distortions and boost the economy." He stated that while prices would remain high, "abusive or speculative prices" would not be tolerated.

Impact of Price Caps and Exchange Rate Fluctuations in Cuba

To provide further insight into the economic situation in Cuba, here are some frequently asked questions regarding the recent developments in exchange rates and price regulations.

Why is the value of the US dollar and MLC dropping in Cuba?

The decline in value is largely due to ongoing economic conflicts, including the government's decision to cap prices on essential goods, which has created uncertainty in the informal market.

How do the new exchange rates affect the purchasing power of Cubans?

The lower exchange rates mean that Cubans will get fewer Cuban pesos for their dollars and MLC, reducing their purchasing power in the informal market.

What products are affected by the government's price cap?

The price cap initially targets essential goods like chicken, oil, powdered milk, pasta, sausages, and powdered detergent.