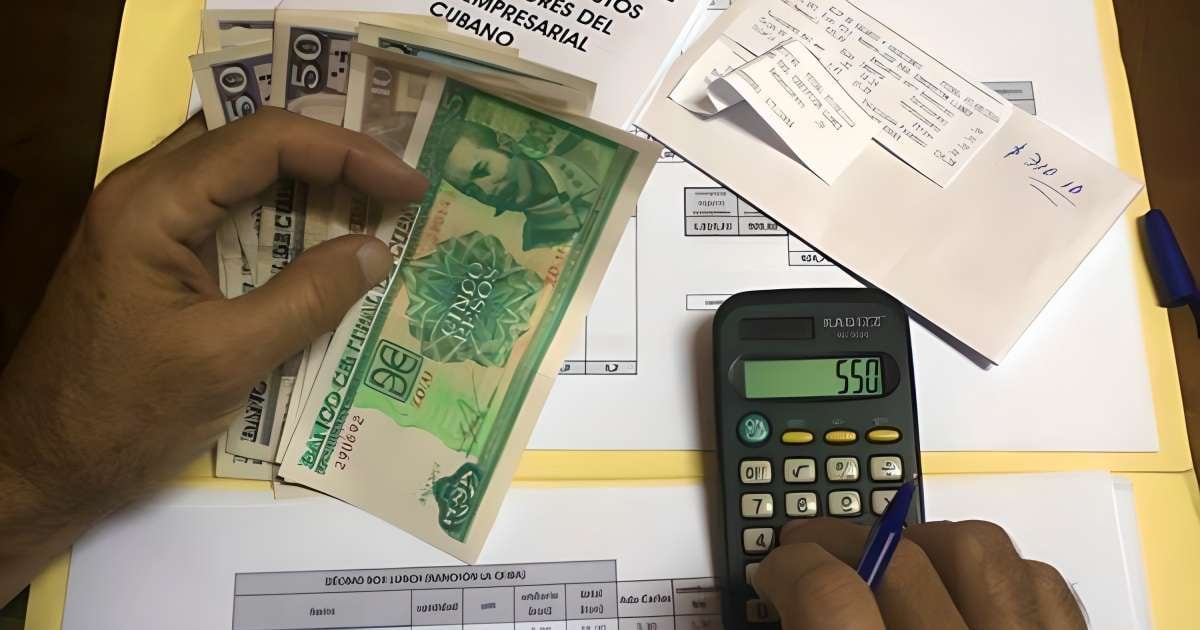

Between January and October of this year, authorities in Matanzas have levied fines totaling over 652 million pesos on private entrepreneurs due to tax evasion. Yenli Ortega Salgueiro, head of the National Tax Administration Office (ONAT) in the province, disclosed to Granma newspaper that despite an overall improvement in taxpayer compliance, significant amounts of money are still being evaded in numerous cases.

In addition to the fines, penalties included the closure of a small and medium-sized enterprise (SME) in the Perico municipality and the temporary suspension of business licenses for 13 others, all due to evading sales tax. Ortega Salguiero highlighted that control actions, audits, and inspections have been carried out with a focus on the most active economic actors and importers.

This scrutiny involved 983 taxpayers: 723 self-employed workers and 260 micro, small, and medium enterprises (SMEs), primarily located in the municipalities of Cárdenas and the provincial capital. Of the 652 million pesos imposed as fines, 76.80% has already been recovered.

In the official’s view, although tax collection in the province has increased this year, it still falls short of the necessary targets. The ONAT has identified the main types of tax evasion in Cuba: underreporting income, failing to declare foreign earnings, and using proxies to hide multiple business operations.

While the regime boasts of intensified control measures, fiscal oversight experts caution that the extent of tax revenue loss remains unknown. In the first half of 2024, the government shut down 15 SMEs due to accounting irregularities.

Judith Navarro Ricardo, a legal specialist at ONAT, reported instances of poor accounting practices, such as misclassifying equipment purchases as direct expenses rather than inventory, along with issues in financial statements, which are often missing or concealed. "An SME not maintaining proper accounting records and failing to meet tax obligations indicates an intent to evade taxes, granting us the right to file a complaint," she emphasized.

Understanding Tax Evasion Challenges in Matanzas

What were the main consequences for businesses caught evading taxes in Matanzas?

Businesses faced fines, closure of operations, and temporary suspension of business licenses for failing to comply with tax laws.

How successful has the recovery of fines been in Matanzas?

As of now, 76.80% of the imposed fines have been successfully recovered by the authorities.

What are the common methods of tax evasion identified by ONAT?

Tax evasion methods include underreporting income, not declaring foreign earnings, and using proxies to hide multiple business operations.