Over the weekend, a woman accompanying a patient waited for hours outside the operating room of a provincial hospital in Matanzas. When hunger struck, she found herself in a predicament: nearby establishments only accepted cash, rejecting digital payments or online transfers.

This scenario, reported by the pro-government newspaper Girón, sheds light on one of the significant shortcomings of Cuba's push towards digital payment systems. While the government aims to encourage digital transactions and cut down on cash usage, the initiative faces numerous technical, economic, and cultural barriers.

Despite official statistics boasting increased issuance of magnetic cards and electronic transactions, many Cubans feel that the shift towards digital payments is stagnating, or even regressing. As noted by the official press and echoed by social media users, the situation is “upside down.”

Businesses frequently cite connectivity issues, non-functional QR codes, unjust fees, or outright refusal to accept electronic payments as daily hurdles. According to Bandec's provincial director, Yanetsy Chávez Camaraza, some businesses resort to offering a worker's personal card number instead of using the institutional route, denying customers the benefits of discounts and bonuses.

Challenges in Implementing Digital Payments

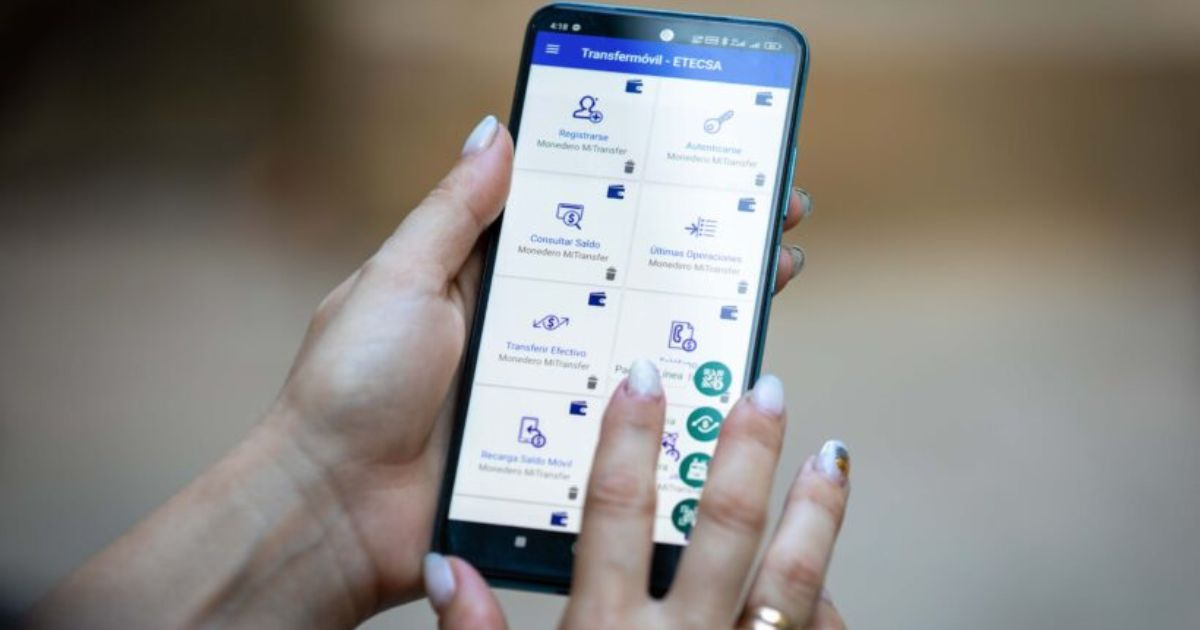

In a commercial landscape that the regime struggles to regulate, customers often hear responses like “we don’t accept transfers today,” “we’ve exceeded our daily limit,” or “we stop using QR after noon.” Businesses often blame connectivity failures for their cash-only policy, despite apps like Transfermóvil not requiring mobile data to operate.

For many self-employed workers, such as an agricultural vendor in Matanzas, digital payments are seen as a hindrance: slow, unreliable, and inconvenient for customers. This technological mistrust, coupled with the inability of many economic actors to access their funds swiftly, leads them to favor cash transactions and operate beyond fiscal oversight. Here, the blame lies squarely with the government and its banking system.

Institutional Efforts and Persistent Issues

Between January and March 2025, Bandec issued over 31,000 magnetic cards and more than 6,700 Multibanca cards in the province, facilitating over three million electronic transactions amounting to more than 8,100 million pesos. However, the bank acknowledges that over 19,000 clients remain unbanked, with the agricultural sector and self-employed workers lagging behind.

Though provincial and municipal task forces, including Bandec, BPA, ONAT, and other entities, are working to advance digital banking, control mechanisms are ineffective. Inspections are limited, and businesses often revert to non-compliance once inspections end.

The ONAT's provincial director warns that businesses without active fiscal accounts could face closure starting April 15. Data cross-referencing between bank deposits and tax declarations has already begun, with planned actions to detect tax evasion.

Structural Barriers and Public Frustration

Despite the regime’s “efforts,” complaints persist. Users report businesses displaying QR codes for show, accepting transfers selectively, or imposing illegal surcharges. Citizens like Marilyn criticize the reliance on public denunciation for law enforcement: “The people shouldn’t have to ensure the law isn’t broken,” she told the media, highlighting the regime's failure in enforcing digital payments.

Structural factors also hinder the success of digital payments: areas without coverage render digital platforms unusable, making cash the only viable option. Provincial Party and Government officials acknowledge unmet expectations, urging increased oversight as a coercive measure.

There’s even a suggestion for CDRs to help monitor businesses in neighborhoods where cafes refuse electronic payments or charge excessive prices. The consensus among authorities, banks, and citizens is evident: without genuine commitment from all parties—from institutions to consumers—Cuba’s digital payment system will remain stuck between well-meaning intentions and a reality that contradicts them daily.

Understanding the Digital Payment Challenges in Cuba

Why are digital payments struggling to gain traction in Cuba?

Digital payments in Cuba face obstacles such as connectivity issues, cultural resistance, and a lack of reliable infrastructure. These hurdles, combined with a preference for cash due to slow access to funds, impede the adoption of digital transactions.

What measures is the Cuban government taking to encourage digital payments?

The government has issued magnetic and Multibanca cards, formed task forces, and is conducting inspections to promote digital payments. However, these efforts are often undermined by ineffective control mechanisms and businesses reverting to cash-only practices after inspections.

How do connectivity issues affect digital transactions in Cuba?

Connectivity problems prevent the consistent use of digital platforms, with businesses often blaming these issues to justify a preference for cash payments. Even in cases where mobile data isn't necessary, such as with Transfermóvil, the lack of reliable internet hampers digital payment adoption.